Understanding the 2022 UK Pension Fund Crisis

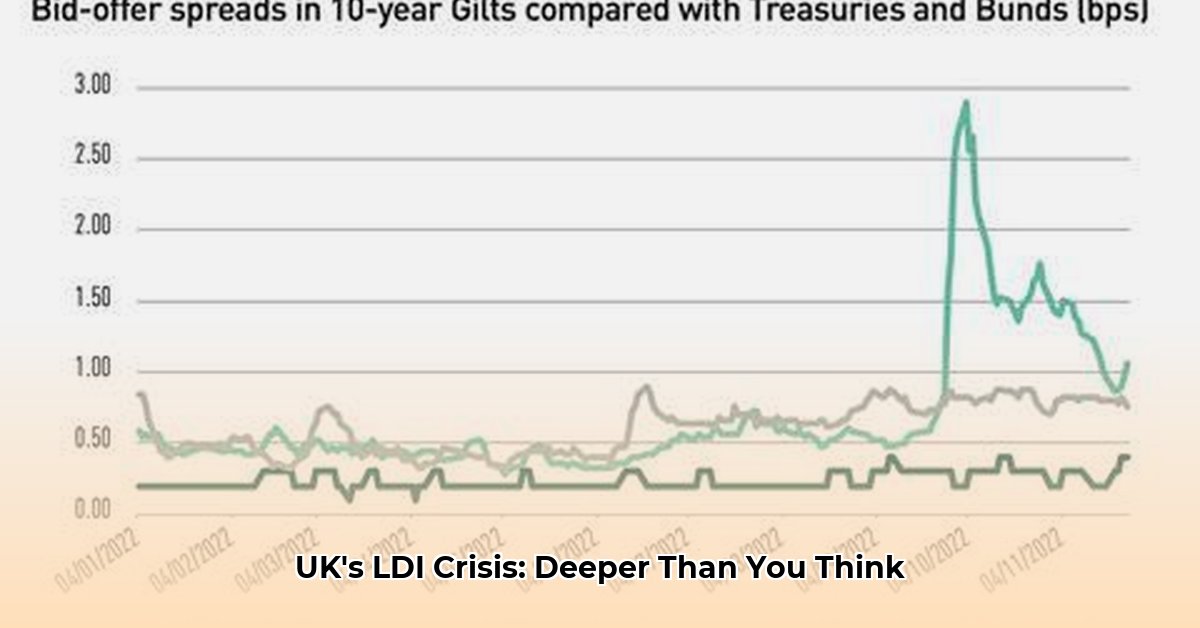

The September 2022 turmoil in the UK gilt market, often dubbed the "LDI crisis," exposed systemic weaknesses beyond simple over-leverage in Liability-Driven Investment (LDI) strategies. This wasn't merely a debt crisis; it was a liquidity crisis amplified by poor communication, inadequate risk management, and slow responses within the pension system. The crisis highlighted the urgent need for improved stress testing, enhanced regulatory oversight, and a reassessment of LDI strategies' risk profiles. How could such a seemingly sophisticated system fail so dramatically?

Did the rapid increase in gilt yields, triggered by the mini-budget, expose inherent flaws in LDI strategies? Or did the crisis reveal more fundamental problems in system design, communication protocols, and operational integration? The answer, as we'll explore, is a complex interplay of both.

The Systemic Failure: Beyond Leverage

While high leverage certainly exacerbated the market shock, the crisis underscored deeper systemic issues. Many pension funds lacked sufficient liquidity buffers to meet margin calls, leading to frantic asset sales that further depressed gilt prices. This points to deficiencies in risk management, stress-testing procedures, and the overall operational efficiency of the system. The speed and scale of the sell-off suggest that models inadequately accounted for extreme market scenarios––a critical oversight. The situation highlights a need for significant adjustments, going beyond simply limiting leverage.

"The crisis wasn't about the inherent risk of LDI strategies," says Dr. Eleanor Vance, Professor of Finance at the London School of Economics. "It was about the system’s inability to manage the risk effectively."

This sentiment is echoed by industry professionals, underscoring the urgency for substantial system-wide reform. The crisis revealed a critical gap in operational resilience, not just a matter of flawed investment strategies.

The Breakdown: Key Contributing Factors

The LDI crisis resulted from a confluence of factors:

- Inadequate Liquidity Management: Many pension funds lacked the readily available cash needed to meet margin calls, forcing fire sales of assets.

- Insufficient Stress Testing: Existing risk models failed to adequately account for the speed and magnitude of the gilt yield spike, highlighting the need for more robust, realistic scenarios in stress testing.

- Poor Communication and Coordination: Slow responses and poor communication between pension schemes and LDI managers exacerbated the problem, hindering effective crisis response.

- Systemic Fragility: The interconnectedness of the system amplified the crisis, with the failure of one element triggering cascading effects throughout.

These interwoven challenges underscore the need for a holistic solution—one that addresses operational inefficiencies, communication breakdowns, and systemic risk.

A Multi-Pronged Approach: Rebuilding Resilience

How can the UK pension system regain stability and prevent future crises? The answer lies in a comprehensive, multifaceted approach:

1. Enhanced Liquidity Management: Pension schemes must hold sufficient liquid assets to withstand market shocks. Diversification of investments can reduce reliance on any single asset class, improving resilience.

2. Rigorous Stress Testing: Stress tests should incorporate more extreme market scenarios, including "tail risk" events, to identify and mitigate vulnerabilities. Regular reviews and updates are essential to keep pace with evolving market dynamics. The use of advanced modeling techniques should be explored.

3. Improved Regulatory Oversight: Stricter guidelines on leverage, mandated liquidity ratios, and enhanced reporting requirements could help prevent future crises. Enhanced collaboration between regulators and industry players is vital.

4. Strengthened Internal Controls: Robust internal control frameworks and transparent governance structures are critical. Clear lines of accountability, improved communication, and coordinated decision-making are essential.

5. Fostering Collaboration and Information Sharing: Open communication and collaboration across all stakeholders will improve crisis response and system-wide resilience.

Risk Assessment Matrix: Prioritizing Mitigation Efforts

The following matrix quantifies the risk associated with various factors contributing to the LDI crisis:

| Factor | Probability of Failure | Impact of Failure | Mitigation Strategies |

|---|---|---|---|

| LDI Fund Structure | Medium | Significant market disruption | Enhanced regulation, improved coordination, robust stress testing, diversification |

| Pension-LDI Communication | High | Forced asset sales, pension shortfalls | Improved communication channels, streamlined processes, technology upgrades |

| System-Wide Fragility | High | Systemic risk, financial instability | Regulatory reform, improved data sharing, enhanced oversight |

Conclusion: Building a More Resilient Future

The 2022 LDI crisis exposed vulnerabilities within the UK pension system. While addressing leverage is crucial, a more profound restructuring is necessary. By strengthening liquidity management, enhancing risk modeling, reforming regulatory frameworks, and promoting better communication and collaboration, the UK can build a more resilient and sustainable pension system—one better prepared for future challenges. The ongoing evolution of the system requires continued vigilance, adaptation, and a commitment to continuous improvement.